Grades 3-5

Don't have an account yet? Sign up for free

Don't have an account yet? Sign up for free

Students will be able to:

In this math lesson, students will use net income & net worth equations to learn about wealth and equality (math).

This lesson is presented by Council for Economic Education in partnership with FiCycle.

Warm-Up

In some cases the terminology and definitions provided in this lesson come from the accounting professions. Economists may define some concepts differently. The use of accounting terminology is intended to aid students’ understanding of their personal financial situation using the language of business.

Introduce the lesson by telling students that they will be exploring why they should think about their financial situation in terms of wealth rather than money. Project slide 1 of the Understanding Wealth PowerPoint. Have a student read aloud the Stingy Steve and Flashy Fiona scenario and then ask the class the following questions:

Most students will say Steve is in the better position as he has more cash.

Project slide 2. Ask another student to read aloud the scenario and then ask the class the same questions. Most students will probably flip their position as more information is introduced, though they may lack the vocabulary to articulate why. If students struggle to understand why Fiona is in a better situation, emphasize each person’s future outlook. Steve has to repay money and does not have a way to earn more, while Fiona is set to gain high income in the future.

Explain to students that there is no direct connection between wealth and cash savings. If you want to know whether someone is in a good position, financially speaking, it is not enough to see how much cash they have.

Modeling

Distribute one copy of the Key Terms worksheet to each student. Use slides 3-10 in the Understanding Wealth PowerPoint to discuss the key terms as the students follow along on the worksheet.

Individual Activity

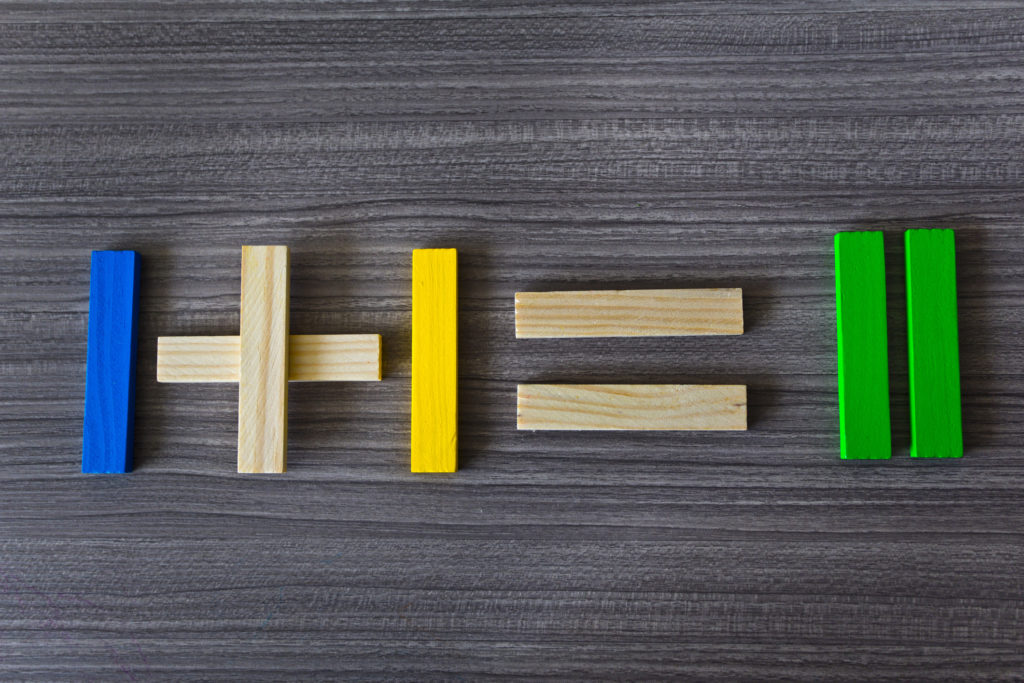

Distribute one copy of ALIE Activity to each student. Use the ALIE Activity Answer Key as a teacher guide for reference. Tell students that ALIE is just an abbreviation standing for Assets, Liabilities, Income and expenses. Also, give each student four colored cards made from the ALIE Card Template: one “A” (Asset) card, one “L” (Liabilities) card, one “I” (Income) card, and one “E” (Expense) card. Be sure that the cards are each a different color, which will give a striking visual indication of what the class is thinking, and whether there is disagreement. Alternately, distribute index cards and have students make the cards themselves. Have students individually read the instructions and complete the activity sheet.

Group Activity

Once students have completed the ALIE Activity come together again as a class. Ask a student to read the first Situation and tell the entire class how he or she completed the table for that situation. After the student has provided his or her response ask the rest of the class to hold up an “A” or “L” card and a “I” or “E” card based on how they responded. If they think the answer is “none” they can just hold up an empty hand with no card. Make sure all members of the class participate. Repeat this process for each Situation. After each Situation, scan the class to see how students have responded. Provide a running commentary of the various answers you are seeing. Call on students to explain their answer – make sure to call on at least one student corresponding to each different answer. If a significant percentage of the class is getting a concept wrong, review it again.

Ask students to come up with situations from their own lives, or give situations that are derivative of those that students struggled with. Have students explain how they would fill out the table for their Situation and ask the class to raise the A/L and I/E cards that they think fit the situation. Ask students to explain their reasoning. Remember that assumptions they make about the situations might make conflicting answers valid. For example, if you buy limited edition sneakers to wear, the sneakers are an expense. If you buy them and never wear them with the intention of selling them (essentially treating them like a work of art) you have acquired an asset.

Grades 3-5

Content Partner

Grades 3-5

Grades 9-12

Grades 6-8, 9-12